Interest-free credit

Why not spread the cost? From a particular product to a full home renovation, bring your ideas to life with interest-free credit from £99 to £15,000. With interest-free credit, you can enjoy:

- 0% APR (Representative)

- No hidden fees

- Flexible repayment terms from 3 months to 4 years*

IKEA Limited acts as a credit broker not a lender and only offers credit products from IKANO Bank. Subject to status UK residents age 18 years and over. T&Cs apply.

*Subject to availability

Learn about interest-free credit:

How it works | IKEA Finance App | Calculate your monthly payment | FAQ | Support | Terms and conditions

You will be redirected to our financial partner Ikano Bank

Remember to include any chosen service eg: installation, delivery or collection services, if required.

General interest-free finance terms and conditions

IKEA Limited acts as a credit broker, not a lender and only offers credit products for Ikano Bank.

Credit is provided by Ikano Bank and is available subject to status to UK residents aged 18 or over. Terms and Conditions apply. To apply, you will need to provide a provisional or full photo driving licence or a valid UK passport and you will need to enter your home address for the last 2 years and your employment status.

Further details are available from IKEA Customer Support, Kingston Park, Fletton, Peterborough, PE2 9ET.

How it works

Our quick and simple application process allows you to turn inspiration into reality, in no time at all.

Please be aware that this is an online product. You will need to be able to apply and manage your account online.

Estimate

Create your shopping list. Remember to include any installation, delivery or collection services, if needed. Then use our calculator to estimate your monthly payment.

Apply

Complete the quick and easy application form on the website or IKEA Finance App. You’ll know if you’re approved within minutes!

Shop

Once approved, accept and sign your agreement, and you'll have up to 90 days to spend your credit in-store or online.

Good to know:

- Your monthly repayments are fixed, so there are no surprises. If you do not spend all your loan amount, your monthly repayment amount will not change but you will pay back the loan over a shorter period.

- Should your application be approved, you will be issued with a virtual card, upon which you will have 90 days to spend up to your loan value. Please consider this when making your application.

- Failure to keep up repayments or to make repayments on time may result in additional charges. This may also affect your credit rating and may impact your ability to borrow in future.

Who can apply, and what you will need for your application

Who can apply?

Credit is provided by Ikano Bank and is available to you if you are:

- a permanent UK resident

- aged 18 or over

- have a good credit history

There are certain exemptions. For full details, before you apply, visit the Ikano pre-eligibility page.

What you will need

To apply, you will need:

- a provisional or full photo driving licence or a valid UK passport

- your home address(es) for the last 2 years

- your employment status

- an email address

- a personal bank account in your name

There are certain exemptions. For full details, before you apply, visit the Ikano pre-eligibility page.

You will be redirected to our financial partner Ikano Bank

Remember to include any chosen service eg: installation, delivery or collection services, if required.

General interest-free finance terms and conditions

IKEA Limited acts as a credit broker, not a lender and only offers credit products for Ikano Bank.

Credit is provided by Ikano Bank and is available subject to status to UK residents aged 18 or over. Terms and Conditions apply. To apply, you will need to provide a provisional or full photo driving licence or a valid UK passport and you will need to enter your home address for the last 2 years and your employment status.

Further details are available from IKEA Customer Support, Kingston Park, Fletton, Peterborough, PE2 9ET.

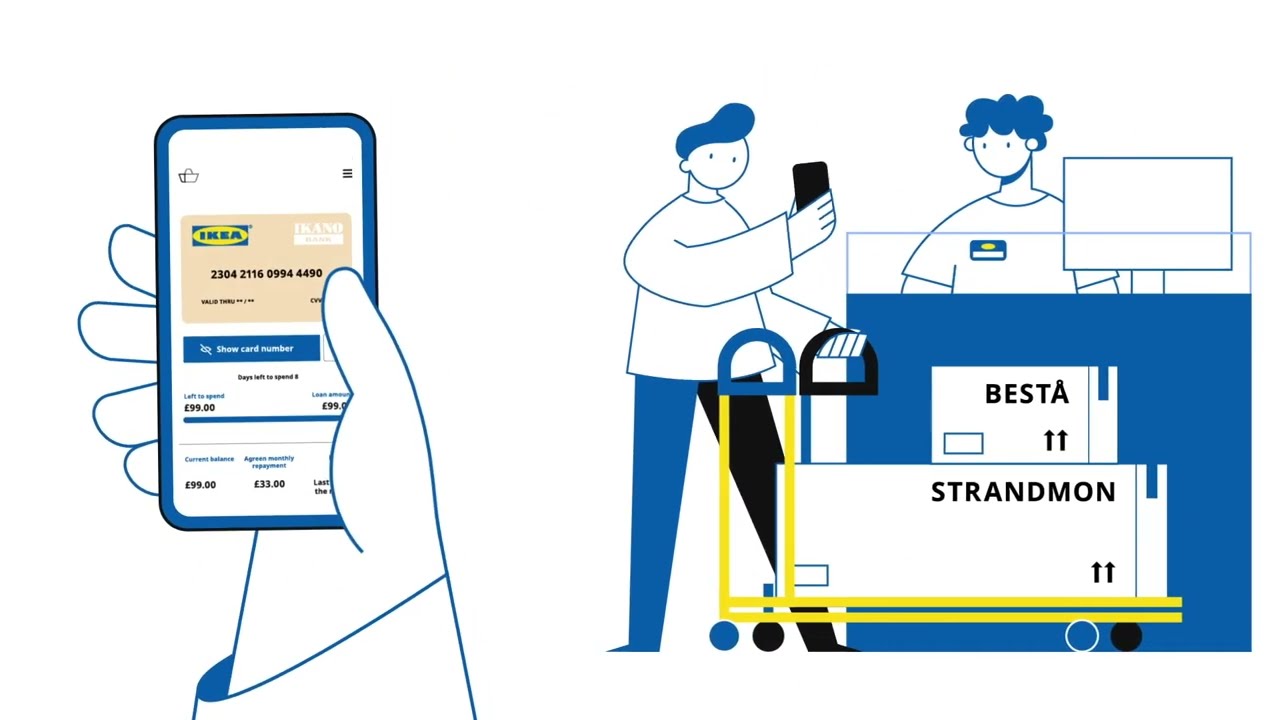

Apply and manage more with the app

Download the IKEA Finance app for an easier application process. Spend your loan straightaway in store and online, manage your repayments and more.

Frequently asked questions

You will not receive a physical card. You can use your virtual card at the tills in our stores and in our online checkout Just log in to your Interest-free credit account and use the virtual card details shown. Your loan and the virtual card is valid for 90 days. If you have not made use of the loan within 90 days, you will have to re-apply.

The decision is entirely made by Ikano Bank. If you have any questions, please visit the Ikano Bank Help Centre ikea.finance.bank.ikano/help-centre

You can use a loan with our Interest-free credit on all our products except IKEA Food products purchased at the IKEA Swedish Food Market, IKEA Restaurant and IKEA Bistro. Please note that installation and delivery/collection services (excluding Task Rabbit services) can be included in the loan amount when applying for a loan.

Our IKEA co-workers can provide support with questions you may have about our finance products or application. However, they cannot process finance applications. It’s simple and convenient to apply for a loan online with Interest-free credit. If you have any issues when you’re applying, please visit the Ikano Bank Help Centre ikea.finance.bank.ikano/help-centre

Our commitment

We aim to resolve all complaints relating to IKEA in a fair, prompt and consistent manner. We also aim to resolve complaints internally and without the need for referral to the Financial Ombudsman Service.

How you should complain

There are multiple ways to make a complaint. Please refer to the Ikano Bank complaint process here

How we respond to complaints

Where the complaint relates to one of Ikano Bank’s finance products or the application process it will be dealt with by Ikano Bank following their complaints procedure which can be found here. Where your complaint relates to our credit broking activities where possible we aim to respond to complaints by the close of business on the business day following receipt of a complaint, however depending on the nature of the complaint it may not be possible for us to do so.

Acknowledgement

Where further investigation is needed, we will always acknowledge receipt of your complaint, by letter, within 7 days of receiving your complaint. Your complaint will be investigated by an employee of sufficient competence who was not involved in the matter which is the subject of the complaint, and who has experience of handling complaints. If you have any questions, or further information that may assist us in investigating your complaint, you should contact this individual using the contact details provided.

Response

Where we have not been able to resolve your complaint within 28 days of receipt we will write to you advising you of the progress of the investigation into your complaint and when we expect to be in a position to do so. In any event we will issue our final response to your complaint within 8 weeks of receipt.

Within 8 weeks of receiving your complaint we will provide a written response to your complaint setting out our position and /or an offer of redress where considered appropriate.

We will also give you details of any rights you may have to refer your complaint to the Financial Ombudsman Service. The Financial Ombudsman Service is an independent organisation with powers to help resolve disputes between consumers and businesses providing financial services. We will also provide you with a copy of the Financial Ombudsman Service’s standard explanatory leaflet.

Time limits you should be aware of

You should be aware that any referral to the Financial Ombudsman Service must be made within 6 months of the final response that we issue to you.

This means Ikano Bank needs to do a few checks before they can give you a final decision. They will be in touch to say what happens next.

Please check the Ikano Bank Help centre ikea.finance.bank.ikano/help-centre or contact Ikano Bank for any questions you may have Contact us - Help and advice | Ikano Bank | Ikano Bank

You can return or exchange any IKEA furniture purchased with our Interest-free credit, in line with our IKEA refunds policy. The refund will be processed by Ikano Bank against your finance agreement in place, a refund is not issued by the store nor contact centre.

If you need to pay for our kitchen installation, delivery or collection services, you can add them to the amount you’re looking to borrow applying for your loan.

Need a little extra help?

Get help from the Ikano support team and learn more about Interest-free credit.

General Terms and Conditions

IKEA Limited acts as a credit broker, not a lender and only offers credit products for Ikano Bank. Credit is provided by Ikano Bank and is available subject to status to UK residents aged 18 or over. Terms and Conditions apply. To apply, you will need to provide a provisional or full photo driving licence or a valid UK passport and you will need to enter your home address for the last 2 years and your employment status. Further details available from IKEA Customer Support, Kingston Park, Fletton, Peterborough, PE2 9ET.